Understanding the eligibility criteria for purchasing an Executive Condominium (EC) in Singapore is essential for prospective buyers. ECs are designed to cater to the “sandwiched class,” providing a more affordable housing option between public housing and private condominiums. Here’s a detailed overview of the key eligibility requirements:

Basic Eligibility Criteria

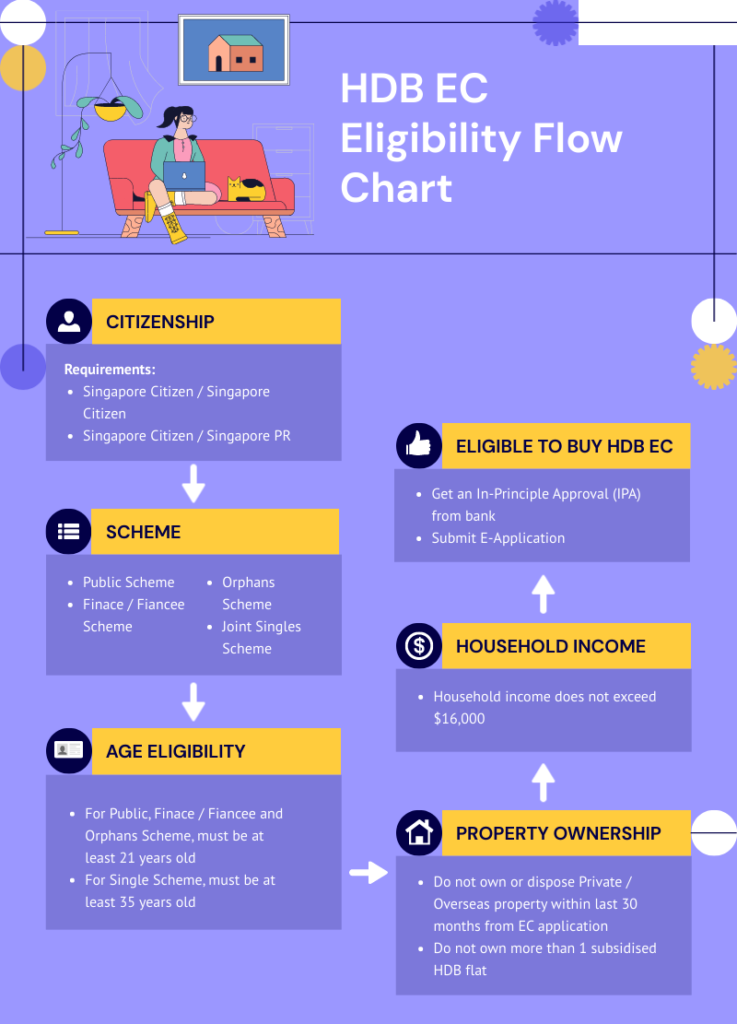

- Citizenship: The main applicant must be a Singapore citizen. At least one other member of the family nucleus must also be a Singapore citizen or a Singapore permanent resident.

- Age: Applicants must be at least 21 years old. For single applicants applying under the Joint Singles Scheme, all applicants must be at least 35 years old.

- Family Nucleus: The application must consist of a recognized family nucleus. This can include:

- A spouse and children

- Parents and siblings

- Children under legal custody

- Siblings who are orphans and single

- Income Ceiling: The household’s gross monthly income must not exceed S$16,000. This ceiling is in place to ensure that ECs remain accessible to the intended demographic.

- Property Ownership Restrictions: Applicants must not own any private property locally or overseas, nor have disposed of any within the last 30 months. This includes properties acquired through inheritance or gifts.

Additional Criteria for Specific Groups

- Single Singaporeans: Single applicants can only purchase an EC under the Joint Singles Scheme, which allows up to four single applicants to apply together. All applicants must be Singapore citizens and meet the minimum age requirement.

- Previous Property Ownership: If applicants have previously purchased a subsidized housing unit (like HDB flats or DBSS), they must have only done so once. Additionally, they must have fulfilled any Minimum Occupation Period (MOP) requirements for those properties.

Minimum Occupation Period (MOP)

- After purchasing an EC, owners must reside in the unit for a minimum of five years before selling it on the open market. This requirement is designed to promote stability in the housing market.

Financing Options

- Buyers must secure financing through bank loans, as HDB loans are not available for EC purchases. It’s essential to understand the different financing schemes available, such as the Normal Progressive Payment Scheme and the Deferred Payment Scheme, to choose the best option for individual financial situations.

Conclusion

The eligibility criteria for buying an Executive Condominium in Singapore are designed to ensure that these properties serve their intended purpose of providing affordable housing for middle-income families. Understanding these requirements is crucial for potential buyers to navigate the application process successfully and make informed decisions about their housing options.